child tax credit october payments

Wait 5 working days from the payment date to contact us. Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

If you think thats why your October Child Tax Credit payment is missing you have two options.

. The first three payments were. Thats an increase from the regular child tax. Child Tax Credit 2022 3 payments each worth 250 going out this month.

Includes related provincial and territorial programs. Some late claimers might get 600 in October. The Child Tax Credit program will provide eligible families with between 100 and 500 per child under 6.

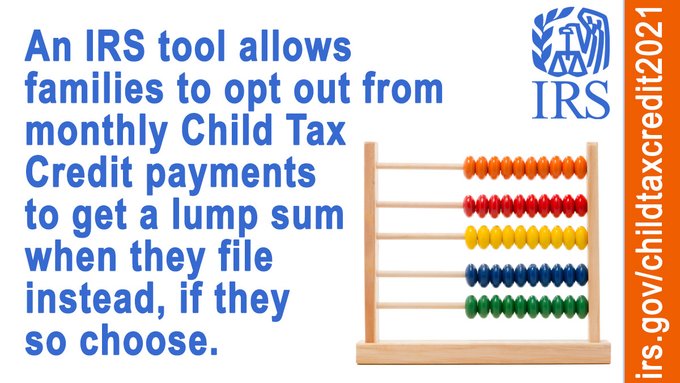

October 4 2022 Elijah Lucas Stimulus Check 0. New Yorkers who received the Empire State Child Credit andor the Earned Income Credit on their 2021 state tax returns are eligible for the new stimulus check. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax. Goods and services tax harmonized sales tax GSTHST credit. To be eligible for the payments residents must have filed their 2021 Rhode Island.

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. Most families will receive the full amount.

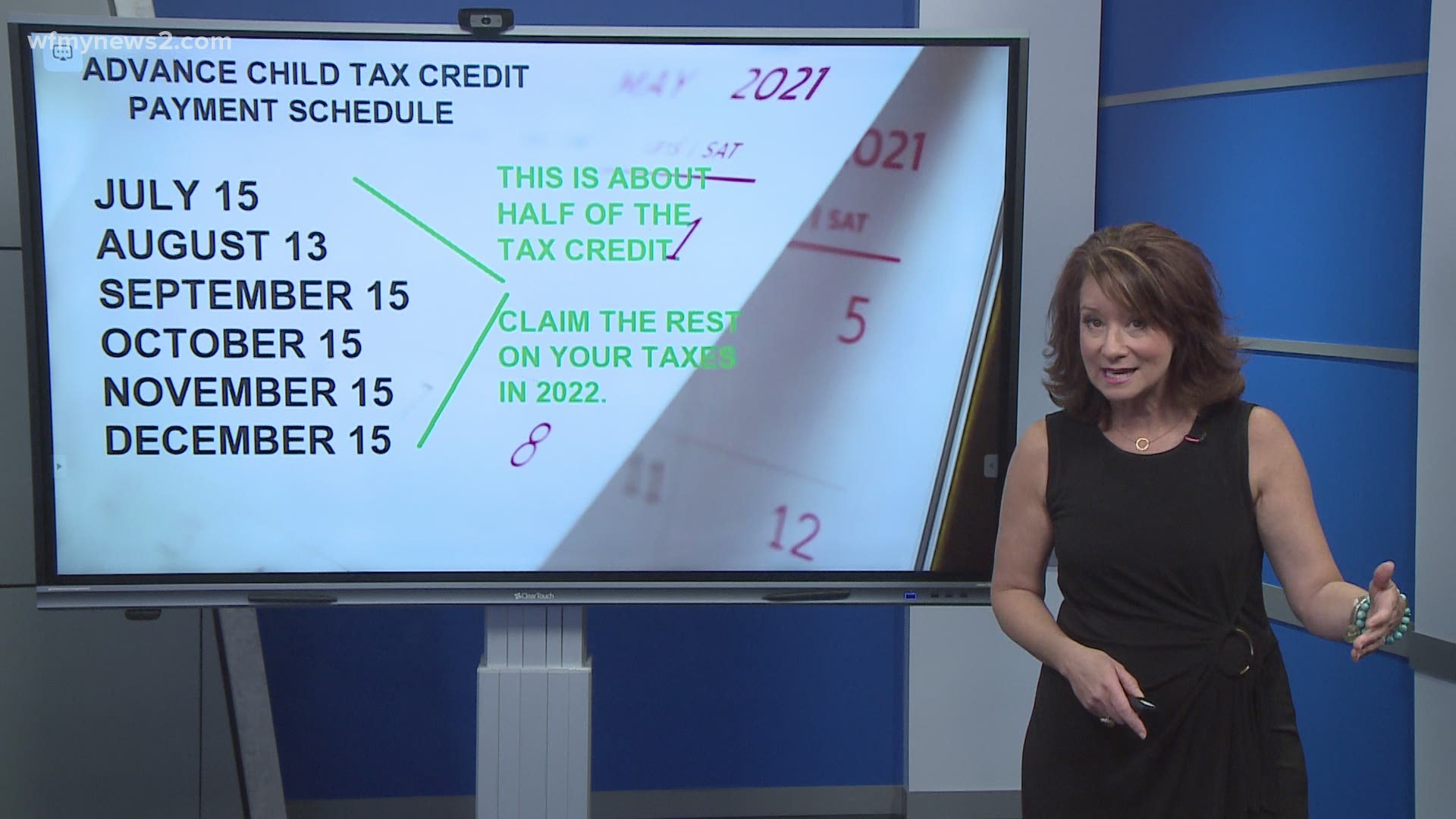

To get money to families sooner the IRS is sending. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. Everything you need to know.

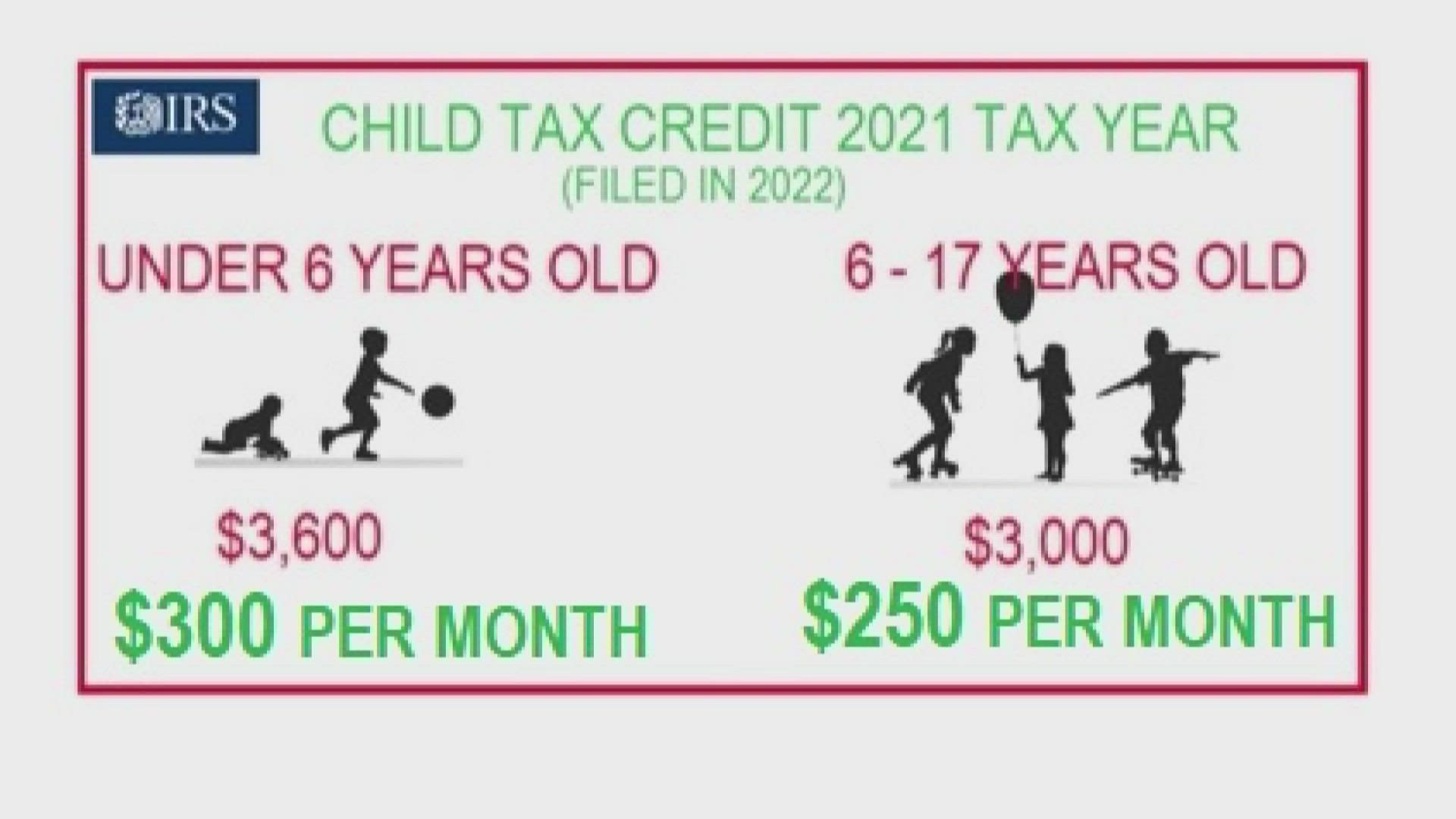

Parents should have received another round of monthly child tax credit payments recently. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. The Child Tax Credits CTC are set to.

One is to wait until you file your 2021 taxes next April and collect the. Supplemental Security Income Benefits. Picture of a US.

Users will need a copy of their 2020 tax return. October 15 2021 142 PM CBS New York. The child tax credits are a part of the American Rescue Plan which was signed into law by President Joe Biden in March.

Child Tax Credit Dates. As part of the. Families will get 250 per child and a maximum of 750 total for up to three children.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. The maximum refundable tax credit of 500 per child under 6 is. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

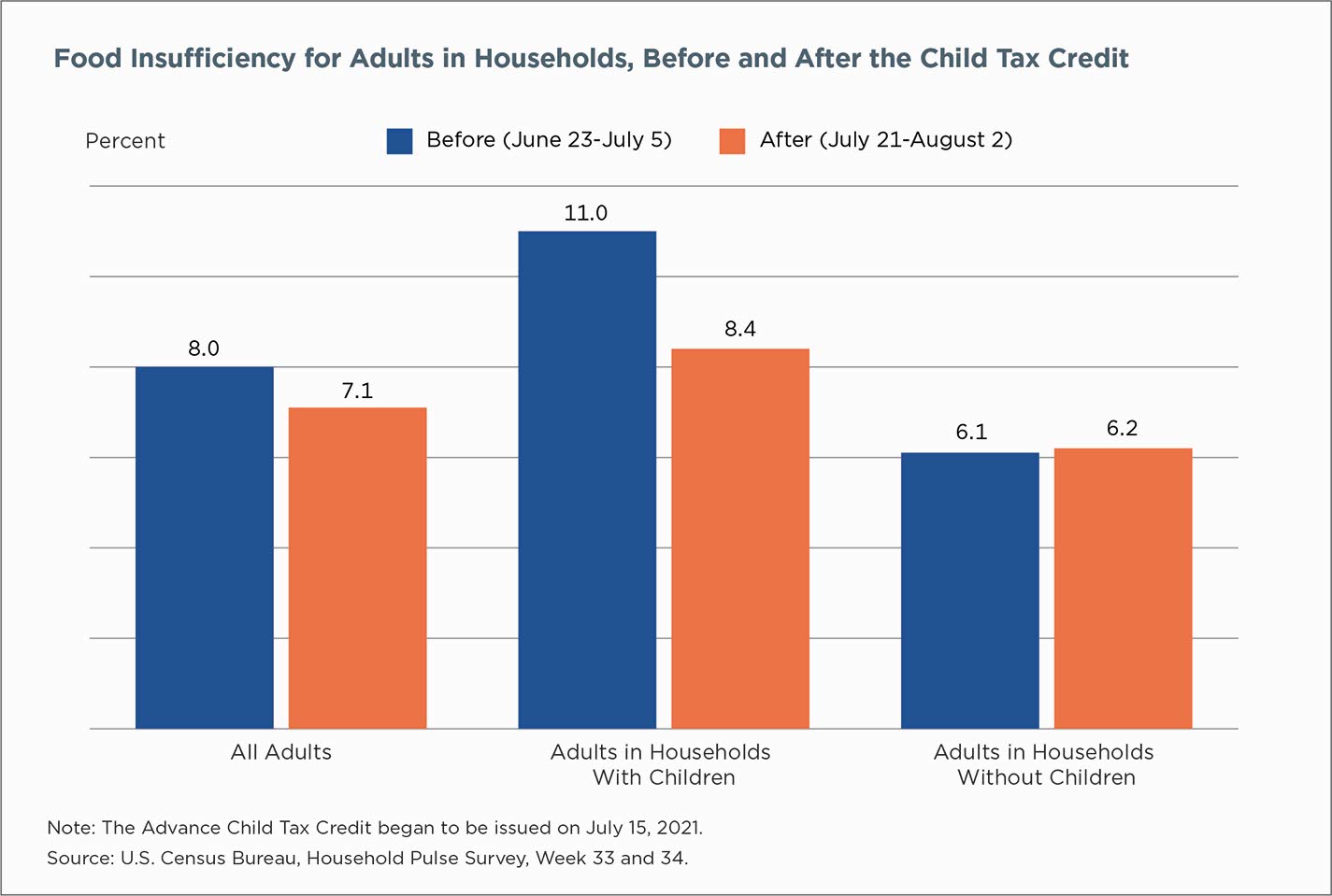

Last year that maximum value increased to 3600 for children under age 6 and 3000. A technical issue that delayed last months payments for a small number of advance child tax credit recipients in September has been fixed the IRS announced Friday. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

The Child Tax Credit reached 611 million children in. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Advance Child Tax Credit Payments in 2021.

Next payment coming on October 15. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax.

Government check Getty Images. The child tax credit scheme was expanded to 3600 from 2000 earlier this.

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Child Tax Credit Update Here S When Your 300 Payment Will Deposit On October 15 The Us Sun

Kansas City Families Prepare For The End Of The Expanded Federal Child Tax Credits Missouri Independent

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Child Tax Credit When Will Your October Payment Show Up Cbs Sacramento

University Of Michigan On Twitter With Support From Umpovertysolutions Npilkauskas And Michelmorek Analyzed Results From A Joinproviders Survey Related To The Child Tax Credit To Learn More About Which Low Income Families Did

What Families Need To Know About The Ctc In 2022 Clasp

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Child Tax Credit First October Payments Coming Tomorrow Marca

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit First October Payments Coming Tomorrow Marca

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

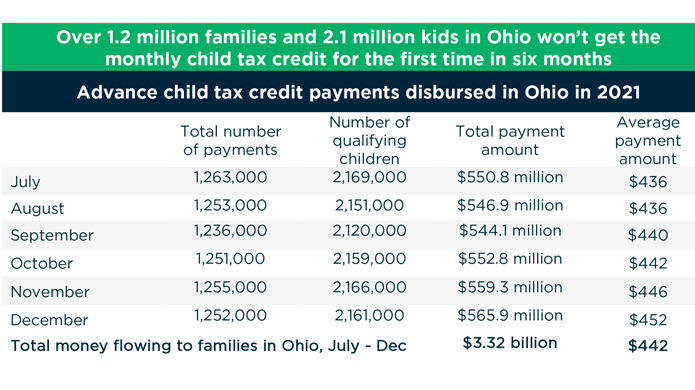

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

October Child Tax Credits Issued Irs Gives Update On Payment Delays

Child Tax Credit 2021 When Will October Payments Show Up King5 Com

Three More Advanced Child Tax Credit Payments To Hit Accounts Wfmynews2 Com